There are specific protocols when billing insurance companies. One of those protocols is filling out the form HCFA. Here’s what to know about this form.

The Health Care Finance Administration (HCFA) form is a claim form used in the settlement of government insurance programs such as Medicare and Medicaid to medical providers. Developed by The Center for Medicaid and Medicare (CMS) but was adopted as a standard form by all Insurance plans.

Clinical practitioners and physicians use the HCFA to submit claims for professional services. Federal regulations require all healthcare providers to use the HCFA or UB-04 form for filing claims.

This form is universal, and all healthcare providers use them to bill health insurance providers. Both Medicaid and Medicare, part B services, are billed using this form. The National Uniform Claim Committee (NUCC) maintains this form.

The HCFA contains all the essential info required to submit a precise claim. In this form, the healthcare provider should include the following;

The information filed in this form should be accurate and factual. To avoid disputes, healthcare providers should be truthful when filling the form. In case the insurance detects irregularities, they may fail to honor the claims.

There is a specific box that applies to each health provider. The payer might provide different info on how to fill some boxes. The medical coder and biller must be familiar with some specific payer requirements.

The Health Care Financing Administration (HCFA) form, also known as the CMS-1500 form, is a standardized paper claim form used by health care providers to submit claims for reimbursement of medical services provided to patients. It is used primarily for billing Medicare, Medicaid, and private insurance companies.

The HCFA form serves as a standardized method for health care providers to submit claims for reimbursement, ensuring that all necessary information is included for accurate and efficient processing.

Individual healthcare physicians and not institutions can only fill this form. Below are some of the people who can fill the form;

Only non-institutional healthcare providers should submit insurance claims using the HCFA form. Institutional providers should submit applications using the UB-04 form.

For the insurance claims to be met, some set industry standards and protocols have to be met. Medical billers use software to record patient data, prepare claims, and submit them to the appropriate insurance provider. However, there is no universal software that the biller must use.

All insurance billing software uses a set of standards set by the HIPAA and the Code Set Rule (TCS). Insurance claims can be filled out manually on paper or electronically. Many healthcare providers prefer the electronic system to the manual one.

The electronic system is faster and more accurate compared to the manual one. However, the medical provider should be well-versed in both methods.

The HCFA form should be filled out according to the provisions of the law. The claims can be rejected if the form is not correctly filled. You can avoid rejection of the claims by doing the following;

The insurance providers need accurate data.

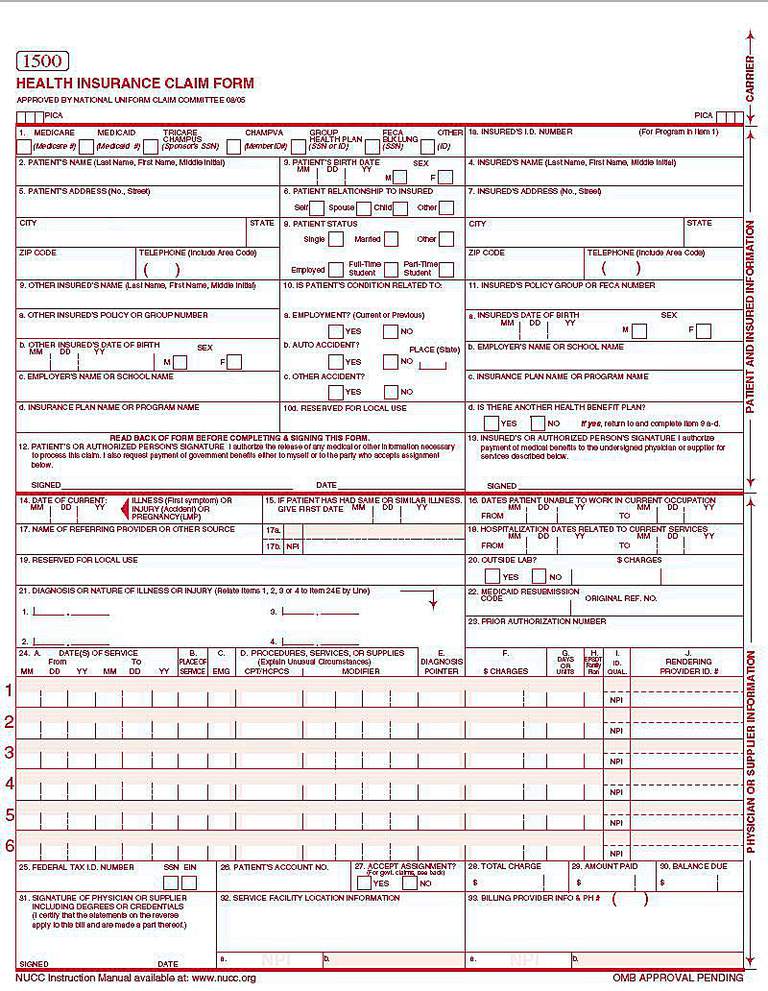

How the biller fills out the HCFA form determines whether or not the insurance provider will offer compensation. The HCFA has 33 boxes that you must fill. Below is a detailed guide on how to fill in each detail.

In this part, you mark the type of health insurance coverage, i.e. Medicare or Medicaid. Also, enter the patients’ insurance number.

Enter the full patient’s name, as shown on the Medicare Card. This section allows entry of up to 28 characters.

In this box, the medical provider should include the patient’s date of birth and gender. Use the 6-digit or 8-digit format.

Enter the name of the insured if not the patient. It can be spouse employment or any other primary. Leave blank if the patient is the one insured.

Enter the patient’s address and zip code. The first line is for street address, city, and state on the second line and zip code on the third line.

Mark one box showing the relationship of the insured, whether spouse, child, etc. Mark the corresponding on the form.

Enter the insured’s city, state, zip code, phone number, and address. If unknown, leave the physical address details blank. Use the employer’s address for worker’s compensation.

Fill in the general status of the patient. Status includes; worker, student, employed, and marital status.

Include there exists additional health coverage for the insured, add in this column. That consists of the extra health coverage details, personal details, employers detail, school, etc.

This part is preserved for Medicaid information. Enter the patient’s Medicaid number if available.

Input the insured’s group number or policy as written in the ID card. This proves that the physician made an effort of determining whether it’s primary or secondary Medicare.

The patient should sign on the file. If the patient is debilitated, then an authorized representative should sign or enter a 6-digit/8-digit alphanumeric date. If a representative signs, the reasons should be indicated on the line followed by the representative’s relationship and personal details.

If the Medigap info is included in section 9, the insured is supposed to authorize the payment by signing in this section. A signature on file is the most appropriate for this section.

When did the patient get ill? The biller should enter the exact date of illness, pregnancy, or illness.

Fill in this information if the boxes 10b and 10c are checked. Use a 6-digit or 8-digit to enter the date of a related patient’s condition.

In this section, enter the date in which the patient was unable to work in the current occupation. This section applies if the patient is unemployed but unable to work.

This section applies if another physician referred the patient. Enter the full name, ID number, and NPI number of the referrer.

If the patient was hospitalized, enter the date of hospitalization. You could leave it blank if there was no hospitalization needed.

The biller should enter the date when the physician’s NPI saw the patient. The payer assigns the identifier to identify the provider uniquely.

The biller should fill this section when billing for diagnostic tests. Mark ‘yes’ if another party other than the provider is offering the service.

All health providers, except ambulance services, should enter a patient’s diagnosis specificity using special codes. The codes should be accurate and correct.

Enter the original reference number in case of resubmitted claims. This section does not apply for original claim submission. Leave this section blank for Medicare

If the medical procedures require QIO approval, enter the QIO prior authorization number. If an investigational device, enter the 7-digit IDE number. For ambulance services, provide the 5-digit zip code of pickup point.

In this section, the biller should include the following;

The above sections do not apply to the pneumococcal or influenza vaccines.

Enter the details of the provider of service (EIN or SSN). This is the unique number used for reporting taxes.

Enter the patient’s number provided by the service provider. This part is not mandatory as it helps the provider to identify the patient.

Tick the appropriate box to agree to the assignment benefits. Assignment benefits include the following;

Be sure to select options that only apply to your case.

The biller should enter the charge of services. Insurance providers require realistic and unexaggerated charges.

The biller should enter the amount paid for the covered services. This does not include discounts.

Leave this section plank. Medicare does not need you to fill this section.

The physician or non-physician offering the service should enter a signature file. The current dates should follow the provider’s signature.

Enter the location of the physician’s facility zip code. This applies for services payable under the provider’s fee schedule.

The biller should enter the facility’s NPI. In this section, the biller should enter their name, address, zip code, and phone number. This is the final section and identifies that the provider is requesting payment for the rendered services.

Healthcare providers in the United States are continuously seeking ways to optimize their revenues and reimbursement processes. One crucial element to this is adhering to the Health Care Financing Administration (HCFA) guidelines. In this article, we will discuss the importance of HCFA compliance, offer strategies for maximizing reimbursements, and highlight common pitfalls to avoid.

The HCFA is responsible for the management of the Medicare and Medicaid programs, which provide health insurance for millions of Americans. Compliance with HCFA regulations is not only a legal requirement but also a key factor in ensuring that healthcare providers receive accurate and timely reimbursements for their services. By closely following HCFA guidelines, providers can minimize claim denials and reduce the risk of audits and penalties.

Maintaining accurate and up-to-date documentation is essential for HCFA compliance. This includes ensuring that patient records are complete and that billing codes accurately reflect the services provided. Providers should invest in training and resources to help staff stay current with coding changes and requirements.

Conducting regular internal audits and reviews can help identify potential areas of non-compliance, as well as opportunities for improvement. These audits can also detect potential fraud, waste, and abuse, helping providers maintain a strong compliance program and avoid costly penalties.

Healthcare providers can benefit from using technology to streamline billing processes and maintain accurate records. Electronic health records (EHRs) and practice management systems can help reduce errors and improve efficiency, ultimately leading to more accurate reimbursements.

Establishing open lines of communication with payers can help resolve issues quickly and efficiently. Providers should regularly review their contracts and reimbursement policies with payers to ensure they are aligned with HCFA guidelines.

While striving for HCFA compliance, healthcare providers should be aware of common pitfalls that can lead to claim denials and reduced reimbursements. These include:

By recognizing and addressing these issues proactively, healthcare providers can improve their HCFA compliance and maximize reimbursements for their services.

In conclusion, HCFA compliance is essential for healthcare providers to optimize their reimbursement processes. By employing strategies such as accurate documentation and coding, regular audits, utilizing technology, and maintaining clear communication with payers, providers can ensure that they are meeting HCFA guidelines and maximizing their reimbursements. Additionally, being aware of common pitfalls and addressing them proactively can further enhance compliance efforts and lead to more accurate and timely payments. Ultimately, a strong focus on HCFA compliance will not only help healthcare providers maintain financial stability but also ensure the delivery of high-quality care to their patients.

Mike Cynar brings buyers and sellers together by producing reviews and creating non biased webpages allowing users to share their experiences on various products and services. He and his staff write informative articles related to the medical field, legal, and other small business industries.